The Perfect Credit Score: What Is It & How To Achieve It

what is the perfect credit scoreWhilst nearly impossible to achieve, the idea of a perfect credit score is definitely an interesting discussion. The answer is 850, in case you were wondering. So how would one go about achieving this almost mythical figure?

what is the perfect credit scoreWhilst nearly impossible to achieve, the idea of a perfect credit score is definitely an interesting discussion. best way to check credit score

The answer is 850, in case you were wondering.

So how would one go about achieving this almost mythical figure?

Obviously implementing good credit habits is an excellent start.

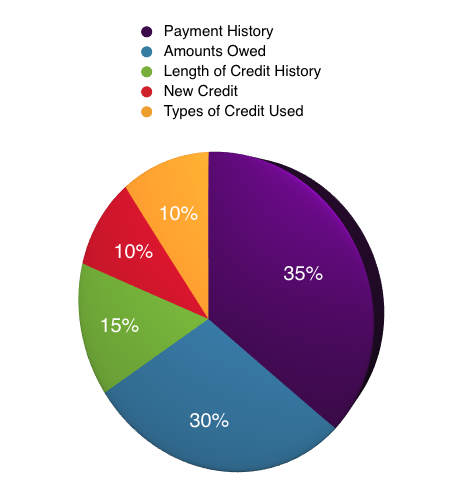

How Your Credit Score Is Calculated

I came up with a handy pie graph (who doesn’t love a good pie graph?) to show you exactly how your credit score is calculated. You can see immediately that your history and what you owe makes up the majority of your credit rating.

Payment history is a whopping 35% of your score, this includes misses, defaults and past due items. This is why it’s important to make your payments on or before the due date.

Amounts owed means (duh) what it is that you owe on your various debts and makes up a non insignificant 30% of your rating.

Length of credit history makes up 15% – this monitors how long you’ve had accounts and the time since there has been any activity on them.

New credit such as accounts that were recently opened, recent inquiries and the number of new credit items applicable to you.

Types of credit used is the remaining 10% and looks at the various types of accounts you may possess, such as retail, installment or revolving.

A Better Question: What’s Actually A Good Credit Score Then?

To determine this, most people look at what is called the FICO Credit Score Range.

This goes from 300 – 850, most people average around the 680 – 700 mark.

The real advantage to possessing a good credit score is that you’ll get better interest rates on your loans, and won’t have to produce as large of a down payment.

Hang on, what’s a “good” score though?

Let’s not overcomplicate it, here’s a graph – ratings go from A – F (with A being the best).

Credit Score Range Graph

A: 750 – 850

B: 700 – 749

C: 630 – 699

D: 580 – 629

F: 300 – 529

So we can see that a good credit score would be an A or B rating on the FICO range. If you want an exact figure, 720 + is a good one to aim for.